All about Medigap Benefits

Wiki Article

Medigap Benefits Things To Know Before You Get This

Table of ContentsGetting My Medigap Benefits To WorkThe Only Guide for MedigapThe Of Medigap BenefitsSee This Report about MedigapThings about Medigap Benefits

You will require to consult with a qualified Medicare representative for pricing and accessibility. It is very suggested that you purchase a Medigap plan throughout your six-month Medigap open registration duration which starts the month you transform 65 and are enlisted in Medicare Part B (Medical Insurance Coverage) - What is Medigap. Throughout that time, you can purchase any kind of Medigap policy marketed in your state, even if you have pre-existing problems.You might need to buy an extra expensive policy later, or you could not have the ability to acquire a Medigap plan whatsoever. There is no warranty an insurance provider will market you Medigap if you look for protection outside your open registration period. As soon as you have determined which Medigap plan meets your demands, it's time to figure out which insurance provider offer Medigap policies in your state.

Called Medicare Supplement, Medigap insurance prepares assistance load in the "voids" in Original Medicare by covering a part of the out-of-pocket expenses Over after Medicare Component A and B protection. The exact protections rely on the sort of plan that is bought and which mention you reside in.

Called Medicare Part C.

This is the percentage of the expense of a solution that you show Medicare. medigap. With Part B, Medicare generally pays 80% and also the patient pays 20%. This is the quantity of cash the client should pay out of pocket for healthcare before Medicare starts spending for the prices. With Part A, there's a deductible that relates to each advantage duration for inpatient treatment in a medical facility setup.

Medigap Benefits Things To Know Before You Buy

, private-duty nursing, or long-lasting care.

Medigap intends can assist you minimize your out-of-pocket medical care costs so you can get inexpensive therapy for comprehensive medical care during your retirement years. Medicare supplement strategies might not be best for every single circumstance, however recognizing your choices will assist you make a decision whether this kind of insurance coverage could aid you manage medical care prices.

Journalist Philip Moeller is right here to give the responses you require on aging and also retirement. His once a week column, "Ask Phil," aims to assist older Americans as well as their families by answering their wellness treatment and also economic concerns.

Some Known Details About What Is Medigap

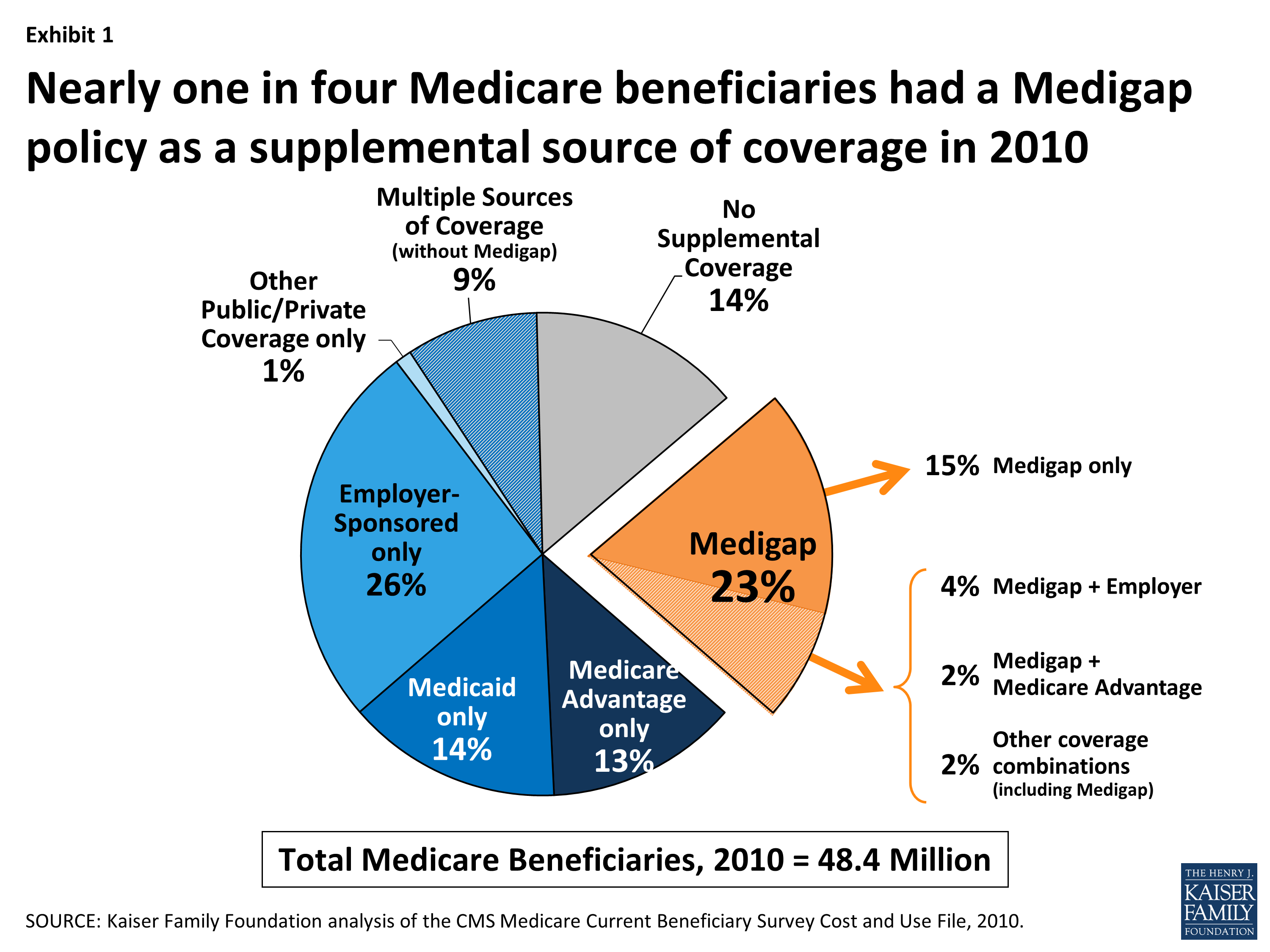

The most significant gap is that Component B of Medicare pays only 80 percent of covered costs. More than likely, even more people would buy Medigap plans if they might pay for the monthly premiums. Nearly two-thirds of Medicare enrollees have standard Medicare, with concerning 35 percent of enrollees rather picking Medicare Advantage strategies.

Unlike other personal Medicare insurance policy strategies, Medigap plans are managed by the states. And also while the certain insurance coverage in the 11 different kinds of plans are dictated by government policies, the prices and also availability of the strategies depend upon state rules. Federal regulations do give ensured concern legal rights for Medigap purchasers when they blog here are brand-new to Medicare and also in some scenarios when they switch over between Medicare Benefit and standard Medicare.

Once the six-month period of federally mandated civil liberties has actually passed, state rules take over identifying the civil liberties individuals have if they want to acquire brand-new Medigap plans. Right here, the Kaiser table of state-by-state regulations is important. It should be a required stop for anyone considering the duty of Medigap in their Medicare strategies.

The Buzz on Medigap

I have not seen tough data on such conversion experiences, as well as frequently tell visitors to examine the marketplace for brand-new policies in their state before they change into or out of a Medigap plan during open registration. However, I presume that worry of a feasible trouble makes many Medigap policyholders resistant to alter.A Medicare Select policy is a Medicare Supplement policy (Plan A with N) that conditions the repayment of advantages, in entire or partially, on making use of network companies. Network carriers are companies of healthcare which have actually gotten in into a go created arrangement with an insurance provider to supply benefits under a Medicare Select plan.

Report this wiki page